FIXED INCOME

Mudra Co-op credit society Ltd has a professionally managed board with bankers having more than 20 years of banking experience. Audit Rating of 'A' as on 31st March'19, which translates into 'stable. All lending and audit practices are merit based without any vested interest. They handle High Net worth individuals funds and offer best in class banking services. Fixed Deposits and Recurring deposit, making Mudra Co-op credit society Ltd your safe and reliable banking partner.

The basic function of a bank is to raise funds and lend. Today Gold loan and Loan against property interest rates across banks and NBFC may vary from 10% to as high as 17%, their interest rates are in the range of 14.5% to 16% and are competitively placed amongst them. They are majorly into secured lending hence minimizing the risk of recovery

NCDs are used as tools to facilitate long term funds by companies through public issue therefore lenders are generally given a higher rate of return in comparison to convertible debentures.

Non-Convertible Debentures (NCDs) have developed as a one-stop solution that continuously instills the investor's confidence in investments through a blend of risk-return profile and ease of liquidity.

Simply put, NCDs are fixed pay obligation instruments issued by an organization wherein an organization agrees to pay a fixed pace of interest on your investment for a specified period so as to raise cash from advertise for business purposes. As the name suggests, these debentures can't be changed over into shares of the issuing organization, not at all like convertible debentures. Interest on NCDs is paid at various timespan like quarterly, semi-every year or every year. They also have an alternative of aggregate interest in which case interest is accumulated and paid on development

Apply Now

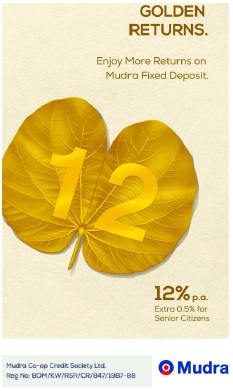

This is a product most understood by investors. Amount remaining in the bank account as savings is converted into fixed deposits. Banks however offer an interest which is not able to beat inflation. As a result, over a period of time the real value of savings lying in bank fixed deposits tend to be lesser in value. For eg. if bank interest rate is 5 % and inflation is 7% then the real earning will be 6.4 % less than actual i.e. 0.32 % reduction. In case of company fixed deposits, the returns are in the range of 8-9 % hence a 0.32% reduction due to inflation will still give a better return.

Apply now